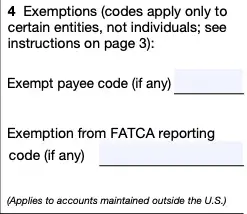

Onlyfans employer identification number - Learn how to fill out a W

Companies that hire sole proprietors You do not hire a sole prop, you subcontract to a sole prop.

There is a lower threshold for 1099s.

Would I be able to give my parents my W2 to file with their tax person then file my 1099 form separately with someone else? You will still need some version of regular turbotax to prepare your personal tax returns.

After it asks if you received any 1099Misc it will ask if you had any income not reported on a 1099Misc.

You will likely need to provide.

Finally, so much of OnlyFans is dedicated to the sexually explicit that many people wondered what would be left if all that stuff was banned.

I have created an onlyfans page and I need to fill...

Anything that you make from OnlyFans is considered a separate from all your other income and is taxed at a different rate look at income tax for sole propietor, it's usually adds up to around 30% flat income tax when all is said and done Here's the catch a lot of onlyfans people don't get.

Description: This assistance line is available Mondays through Fridays from 7:00 a.

User Comments 3

More Photos

Latest Photos

Latest Comments

- +154reps

- You will likely need to provide.

- By: Nesbitt

- +351reps

- This requirement is similar to the way that companies have to report all wages paid to employees.

- By: Olsen

- +124reps

- When you create an OnlyFans or Myystar account to become a creator, they are going to require you to fill out a form W-9.

- By: Johnathon

- +693reps

- So you get social security credit for it when you retire.

- By: Dyer

- +54reps

- Remember, that you are not an employee of OnlyFans and Myystar, you are a business owner.

- By: Pistol

DISCLAIMER: All models on sexyass.pages.dev adult site are 18 years or older. sexyass.pages.dev has a zero-tolerance policy against ILLEGAL pornography. All galleries and links are provided by 3rd parties. We have no control over the content of these pages. We take no responsibility for the content on any website which we link to, please use your own discretion while surfing the porn links.

Contact us | Privacy Policy | 18 USC 2257 | DMCA

(mh=iVLjs7fmvjtB0yMR)9.jpg)